Insurance Services

Worker's Compensation Insurance

What is workers’ compensation insurance?Workers’ compensation insurance, also known as workman’s comp or workers’ comp, gives your employees benefits if they get a work-related injury or illness. These benefits can help:

- Cover their medical care

- Replace most of their lost wages if they take time to recover

- Provide disability benefits

- Pay for their funeral if they lose their life

Workers’ comp also has benefits for you, as a small business owner. If your injured employee or their family sues your business, it can help cover your legal costs.

Business Owner's Policy

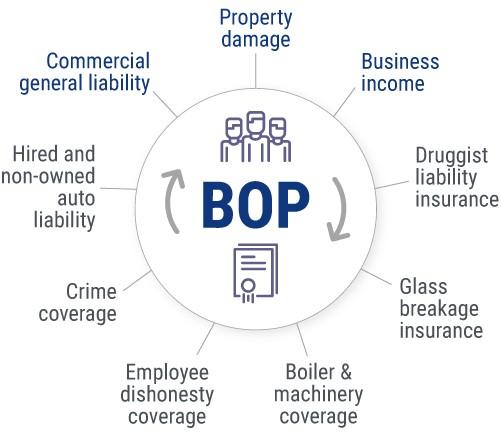

A BOP bundles several types of coverage in one package, similar to how a homeowners policy works but is designed for small and mid-sized businesses.

Most business owner’s insurance policies combine the following types of coverage in one convenient bundle:

- Commercial property insurance — Covers losses to property from common perils. It also covers office equipment, furniture, inventory, machinery, raw materials, computers, and anything else vital to business operations.

- General liability insurance — Covers a company’s legal responsibility for any harm it may cause to others up to the policy limit. It also covers attorney fees and medical bills for anyone injured by the company.

- Business interruption insurance — Reimburses for loss of income if a covered disaster interferes with the successful operation of the business.

As well as dozens of other insurance coverages that cover common exposures for small and mid-sized businesses.

Commercial Auto

When it comes to running a business, vehicles are crucial to getting things done. Whether its transporting materials and tools to worksites, hauling goods for delivery or driving to meet clients–your business relies on safe and functioning vehicles to serve customers and generate profits.

As you know, an accident can happen to even the most careful driver—and these accidents can cost thousands or even millions of dollars.

Commercial vehicle insurance for both owned and leased cars and trucks protects your business in many important ways. Quinton Insurance offers coverage for:

- Liability Coverage – if you’re responsible for harming others or for damaging their vehicles or property.

- Uninsured Motorist Coverage – for when your vehicles, property and/or people are injured by a 3rd-party that can’t pay the damages.

- Physical Damage – if your car is damaged or destroyed in an accident or by something other than an accident, such as theft, vandalism or hail.

- Medical Expense – for the costs for you or your passengers’ injuries.

- Unique Equipment Coverage – for modified vehicles needed to perform your work safely and efficiently (i.e crane, lift, etc).

Auto Insurance

In California, the basic auto insurance coverages are

- Bodily Injury Liability: Covers expenses related to injury or death of someone in an accident you caused.

- Property Damage Liability: Covers expenses related to damage caused to someone else's property in an accident you caused.

- Uninsured Motorist Bodily Injury: Covers your medical expenses and lost wages if you're in an accident with an uninsured or hit-and-run driver.

- Underinsured Motorist Bodily Injury: Covers your medical expenses and lost wages if you're in an accident with a driver who doesn't have enough insurance to cover your expenses.

- Medical Payments: Covers your medical expenses and those of your passengers, regardless of who is at fault.

- Collision: Covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive: Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

Every situation is unique — talk to us today to find out how to get the best value on auto insurance.

To expedite our review of your current insurance coverage, use our insurance policy review link

Home Insurance

In California, the basic home insurance coverages are

- Dwelling Coverage: Covers the cost of repairing or rebuilding your home in the event of damage or destruction caused by a covered peril, such as fire or severe weather.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, clothing, and electronics, if they are damaged, destroyed or stolen.

- Liability Coverage: Protects you from financial loss if you are found liable for injuring someone else or damaging their property.

- Medical Payments Coverage: Covers medical expenses for guests who are injured on your property, regardless of fault.

- Additional Living Expenses Coverage: Covers additional costs, such as hotel bills, if you need to temporarily relocate due to damage to your home that's covered by your policy.

- Other Structures Coverage: Covers the cost of repairing or rebuilding structures on your property that are not attached to your home, such as a shed or garage.

- Loss of Use Coverage: Helps cover additional living expenses if you can't live in your home while it's being repaired or rebuilt due to damage or destruction caused by a covered peril.

Every home is unique – talk to us today to find out how to get the best price and value on homeowners insurance for you.

To expedite our review of your current insurance coverage, use our insurance policy review link

Umbrella Insurance

CALIFORNIA – WHAT’S PEACE OF MIND WORTH TO YOU?

An umbrella policy provides additional layers of liability protection. If the liability limits are exhausted on your home, auto, or other underlying insurance policy, your umbrella insurance policy takes over and provides you with additional protection. The cost is minimal compared to the comfort of knowing you’re covered.

In California, the basic umbrella insurance coverages are

- Personal Liability Coverage: Provides additional liability coverage beyond the limits of your other insurance policies, such as your auto or home insurance policy.

- Property Damage Liability Coverage: Covers the cost of damage to someone else's property for which you are found liable, such as damage caused by an auto accident or an accident that occurs on your property.

- Bodily Injury Liability Coverage: Covers the cost of injuries or death for which you are found liable, such as injuries sustained by someone in an auto accident or on your property.

- Landlord Liability Coverage: Provides liability coverage for rental properties that you own, beyond the limits of your standard landlord insurance policy.

- Libel and Slander Coverage: Protects you against claims of defamation, such as if you are accused of making false or damaging statements about someone in a public forum.

- Legal Defense Coverage: Helps pay for the cost of legal defense if you are sued and need to hire an attorney.